Mergers & Acquisitions

Commercial Due Diligence

A Commercial Due Diligence is the process of appraising a target by reference to its market and, above all, whether the company is positioned to succeed. Looking at a target’s relevant sources of valueand risks, while and validating our clients’ investment theses can considerably boost chances for a successful transaction.

Our industry expertise with respect to Commercial Due Diligences is concentrated to the global healthcare industry: hospital, clinic and care, medical devices, medical engineering, medical products, medical packaging and logistics, labs, diagnostics, pharmaceuticals, API, nutrition, etc.

ConAlliance offers different types of Commercial Due Diligence, from "Quick Check" to "Red Flag" to full Commercial Due Diligence.

Approach

Our approach to Commercial Due Diligence informs our clients’ investment decisions by providing independent, fact-based analysis regarding a target’s most crucial commercial and operational issues in order to reveal the target’s strengths and weaknesses.

As a corporation or institutional investor it is indispensable to understand the numbers behind the target's current and expected performance. Thus Commercial Due Diligence is deeply analyzing the sustainability of a business.

Conalliance, with its solid focus, delivers a deep analysis of the target’s business model and a more thorough understanding of the market niches within healthcare, the regulatory landscape, the market trends and dynamics, the competitive positioning and the customer perception through primary and secondary research. Of course we will discretely interview market participants, customers and competitors, to obtain their views.

Conalliance, with its solid focus, delivers a deep analysis of the target’s business model and a more thorough understanding of the market niches within healthcare, the regulatory landscape, the market trends and dynamics, the competitive positioning and the customer perception through primary and secondary research. Of course we will discretely interview market participants, customers and competitors, to obtain their views.

We use our enhanced Commercial Due Diligence process to conduct in-depth analysis of the value chain and product life cycle, cash flows, margins, financial planning. As a result we will review the target’s business plan and investigate multiple cost/revenue scenarios.

Additionally, our ability to undertake complex technical due diligence, to understand the context of the technology within a changing market and to provide a clear insight is highly valued by our customers.

Our approach implies to combine rigorous analysis with a fact-driven assessment in order to identify also hidden topics. We know what the market drivers are in order to leverage the unique capabilities of a target.

Thus we deliver the independent validation required for acquirers to make profound investment decisions confidently.

Provision of Information

ConAlliance has served the healthcare industry as a specialised investment banking and M&A advisory firm with a significant trackrecord in value creating deals - both on the sell- and buyside. ConAlliance's offices in the UK, Germany, USA and Asia, our scale, reach and local knowledge is focused on supporting clients. Our network comprises of offices and partners in all major European capitals, and in Americas and Asia. We provide a global network to the key decision makers within the life science and healthcare industries, on a national and international level.

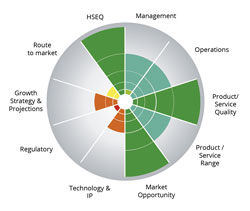

possible content of a full Commercial Due Diligence

possible content of a full Commercial Due Diligence

|

Marketsegments, -size, -profitability, -growth, -potential, -drivers, regulatory framework |

|

Added value/ creation of value, growth strategy, sustainability, ... |

|

Product portfolio, product range, market for each product/service, sales drivers, pricing, margins, profit (against competition), ... |

|

Financial benchmarking, strategic positioning, performance (in comparison to client) ... |

|

Dependencies, loyalty, potentials |

|

Dependencies, supplier structure |

| Market strategy, value proposition, market choices, distributors, | |

| Technology, manufacturing, distribution, services, marketing, ... | |

|

Performance potentials, management |

|

Validation of assumptions, ... |

|

SWOT-Analysis, ... |

| Strategic fit, buy & build strategy, exit-options, business case |

Commercial Due Diligence case studies

Commercial Due Diligence case studies

Case study 1

A UK - based private equity investor was bidding for a European private Medical Device company.

The private equity firm asked Conalliance to conduct the market and commercial due diligence on the specific niche market and to provide an independent recommendation on the potential investment. The Conalliance-team faced two challenges: the lack of public information on this small niche sector and the accelerated timeline of three weeks. Nonetheless, the team accomplished its mission:

- Projected the market over the three to six years through interviews with more than 20 experts in the specific niche, including medical practitioners, scientists active in this field, clients and potential clients, suppliers and competitors.

- Provided estimates of market size and penetration in benchmark countries, mapped competitors, characterized the value chain, and evaluated the dynamics in markets with public versus private markets (also with different reimbursement issues) and analysed margins

- Moreover analysed the "typical" issues within a Commercial Due Diligence, as e.g. additional market issues, customers, competitors, etc.

- Generated an alternative business plan that included sell-side and buy-side cases, after challenging the target company’s business plan and feasibility assessment

- Evaluated the financial feasibility of the transaction. While investment banks usually conduct these analyses, the Conalliance team drew upon its significant healthcare and corporate finance experience to provide this level of support in a short time.

The Conalliance-authored business plan had been used to secure financing from banks for the management buyout. The private equity firm wholly acquired the target company. The acquisition of this medical device manufacturer represents the first step in creating a European leader by building on the company’s strong market position in Germany, Austria, Switzerland, France, Italy and Spain, the PE firm planned to increase the group’s international presence by acquiring leading companies in different geographies and diversifying into adjoining technologies and products.

Follow-up mandate: Buy-and-build buyside advisory

In the following step Conalliance advised and supported the PE firm in searching, screening, evaluating, contacting potential targets, fitting to the client’s buy-and-build strategy. Within the filtering process, profiles of about 10 interesting acquisition targets were identified. Top targets were discreetly approached, with the outcome, that five interesting acquisition targets expressed interest in further negotiation. Conalliance conducted site-visits and negotiation at target’s headquarters. After that, two targets with the best fit were identified and negotiations intensified. Finally, the client acquired the two top-priority targets. Integration effort was successful with target outperforming aggressive projections.

Case study 2

Commercial Due Diligence on medical product (life science) company with a new wound-care technology

An international health care company wanted to expand its wound-care business by making an important purchase in the industry. To back up the planned investment decision, a Conalliance commercial due diligence team executed a market and commercial due diligence on the acquisition target, an international family-owned company. Firstly this included an extensive analysis of markets and competition as well as the development of a market model. The Conalliance commercial due diligence team also checked and remodelled the business plan submitted by the target's management.

But most importantly the Conalliance commercial due diligence team had to identify how well the acquisition target's technology assets meet the acquisition goals and identify risks due to intellectual property issues, registration and capability gaps in the technology assets. Addressed questions included: Will this technology work? Is it practical and effective? Is the technology grounded in sound science? Is the process scaleable and commercializable? What are its strengths and weaknesses? Is this really a unique and proprietary technology?

Based on Conalliance's commercial due diligence report and recommendation, the strategic investor made its investment decision. The company was able to strengthen its wound-care division through the acquisition thereby opening new doors to international growth opportunities.

Case study 3

Rapid Commercial Due Diligence on a laboratory chain

A private equity firm was considering the acquisition of a mid-size laboratory chain that appeared to have higher than normal SG&A costs. To develop its bid, the client needed to understand SG&A in this laboratory chain and potential opportunities to reduce costs.

But the clock was ticking rapidly: the client had been down-selected, and with two weeks to submit a final bid, needed a recommendation within 10 days.

- The company turned to Conalliance to provide the necessary information.

- The Conalliance team:

- Documented how key SG&A processes are performed and what resources are required

- Developed baseline of operating cost by function, focusing on the high-cost areas

- Evaluated key functions against benchmarks, highlighting opportunities to improve by aligning resources, consolidating, improving processes, outsourcing and automation

Delivered a report on the opportunities, which the client used to validate the investment thesis and establish its offer partnering with Conalliance enabled the client to refine its operational assumptions and generate a competitive bid.

The team identified short-term cost reduction opportunities of 5 to 11 percent, with an additional 12 to 18 percent targeted in the longer term. Furthermore, improved resource management and project selection could improve utilization by 15 to 20 percent.

More case studies

Conalliance Commercial Due Diligence team conducted a three-digit number of Commercial Due Diligences in health care.

Further examples of Commercial Due Diligence conducted by Conalliance were in the following niches:

-

Commercial Due Diligence on a manufacturer of endoscopy devices

-

Commercial Due Diligence on a manufacturer of endoscopy equipment

-

Commercial Due Diligence on a dental Implants & Prosthetics manufacturer, which covered segments such as crowns and bridges, dentures, and abutments

-

Commercial Due Diligence on a European Vascular Access Devices company

-

Commercial Due Diligence on a Cardiac Prosthetic Devices (medical devices) producer

-

Market intelligence on Medical Suction

-

Commercial Due Diligence on a Manufacturer of Medical Gases (Oxygen, Nitrogen, Nitrous Oxide, Helium, Gas Mixture) and Equipment (Delivery System, Cryogenic Freezer, Oxygen Concentrator)

-

Commercial Due Diligence on a Manufacturer and distributor of In Vitro Diagnostics (IVD) Technology (Immunoassay, Clinical Chemistry, Molecular Diagnostics, Microbiology)

-

Commercial Due Diligence on a Manufacturer of Lab Accessories (Label Printer/ Pipette tips/ Pumps/Microplate/Reagent Reservoir/Valve/Tubing/Wash Station) and Laboratory Centrifuges

Powered Surgical Instruments

-

Commercial Due Diligence on a Parenteral infusions manufacturer (cytostatics/oncology drugs, total parenteral nutrition infusions, antibiotics and other sterile infusion fluids)

-

Commercial Due Diligence on a Enteral Feeding Devices manufacturer (Feeding Pump, Feeding Tube, Giving Set, Enteral Syringes)

-

Commercial Due Diligence on a leading German medical laboratory chain

-

Commercial Due Diligence on a Non-medical Laboratory chain, which is primarily active in environmental analysis, foodstuff analysis, consumer goods analysis, pharmaceutical analysis

-

Commercial Due Diligence on a mManufacturer of medical bandages and orthosis manufacturer

-

Commercial Due Diligence on a manufacturer of medical lasers

-

Commercial Due Diligence on a radiology chain in Switzerland

-

Commercial Due Diligence on a Medical Packaging Company in Switzerland

-

Commercial Due Diligence on a manufcturer of advanced woundcare (foam, alginate, NPWT, active), surgical, traditional, for chronic (DFU, Pressure Ulcer) and acute (burn) wounds

-

Commercial Due Diligence on a leading group of independent distributors of high quality ophthalmic products used by eye surgeons (provision of artificial lenses, surgical kits and consumables)

-

Commercial Due Diligence on a leading hospital chain in Germany

-

Commercial Due Diligence on a leading portfolio of psychosomatic rehabilitation clinics in Germany

-

Commercial Due Diligence on a Foster home chain (portfolio > 50)

-

Commercial Due Diligence on a Manufacturer of bone cements

-

Commercial Due Diligence on a Manufacturer of biomaterials (synthetic substitutes and tissue-regeneration products with and without antibiotics)

-

Commercial Due Diligence on a Manufacturer of wheelchairs

-

Commercial Due Diligence on a Manufacturer of wheelchair accessories

-

Commercial Due Diligence on EBT device manufacturer (radiation therapy)

-

Commercial Due Diligence on a manufacturer of gypsum powders used for dental, medical and molding applications - and precious dental alloy ingots and discs

-

Commercial Due Diligence on a manufacturer of medical ultrasonic devices

-

Commercial Due Diligence on a Manufacturer of NPWT (negative pressure woundcare treatment)

-

Commercial Due Diligence on a Swiss API company (active pharmaceutical ingredients) / manufacturer of fine chemistry

-

Commercial Due Diligence on a manufacturer of tracheostomy and laryngectomy products in UK

-

Commercial Due Diligence on a manufacturer of medical silicone products in Germany

-

Commercial Due Diligence on a manufacturer of folding cartons, used in the medical and medical technology industry

-

Commercial Due Diligence on a manufacturer of medical plastic products in DACH-region (Germany, Austria, Switzerland)

-

Commercial Due Diligence on a orthopedic clinic chain

-

Commercial Due Diligence on a Psychosomatic and psychiatric acute hospital chain in Germany

-

Commercial Due Diligence on a Psychosomatic and psychiatric rehabilitation clinic chain

-

Commercial Due Diligence on a several acute and rehabilitation hospitals

-

Commercial Due Diligence on a Magnetic Resonance Imaging (MRI) company

-

Lab Automation (Commercial Due Diligence)

-

Commercial Due Diligence on a Non-PVC bags manufacturer

-

Commercial Due Diligence on an ambulant intensive care provider in Germany

Conalliance delivers market leading expertise in the conduction of Commercial Due Diligenes of health care companies.

Generally speaking our core expertise can be found in the segments of medical devices, medical products, hospital, clinic, rehabilitation, special care, home care, pharmaceuticals, laboratory, diagnostics, medical logistics, medical packaging, health care IT, medical services, medical distribution, cosmoceuticals, nutraceuticals, nutritional supplements and in many other health care niches.

If you are interested in our Commercial Due Diligence services, please do not hesitate to contact us.

Quicklinks

![]() Financial Due Diligence

Financial Due Diligence

![]() Healthcare real estate appraisal

Healthcare real estate appraisal

![]() Valuation analysis

Valuation analysis

![]() Healthcare real estate appraisals

Healthcare real estate appraisals

![]() Overview: Healthcare Expertise

Overview: Healthcare Expertise

![]() Overview: Mergers & Acquisitions

Overview: Mergers & Acquisitions

Quickcontact

Please contact your expert

in healthcare investment banking and M&A advisory

Please contact your expert

in healthcare investment banking and M&A advisory